Crypto markets are volatile. As crypto trading and investing became more attractive, there was a need for a stable asset to fall back to when markets became choppy.

In traditional finance, an investor can exit the market and withdraw fiat back to their bank account. This interoperability between traditional finance and crypto markets was lacking.

There was a need for an asset that behaved like fiat but had the mobility and utility of crypto.

Stablecoins are a novel solution to this problem. Price stability is built into them as they are backed by some stable real-world asset, in most cases dollar.

Stablecoins are very popular today with a market cap of $173 billion.

Stablecoins are minted on the blockchain and hence they bridge the gap between the US dollar and cryptocurrencies.

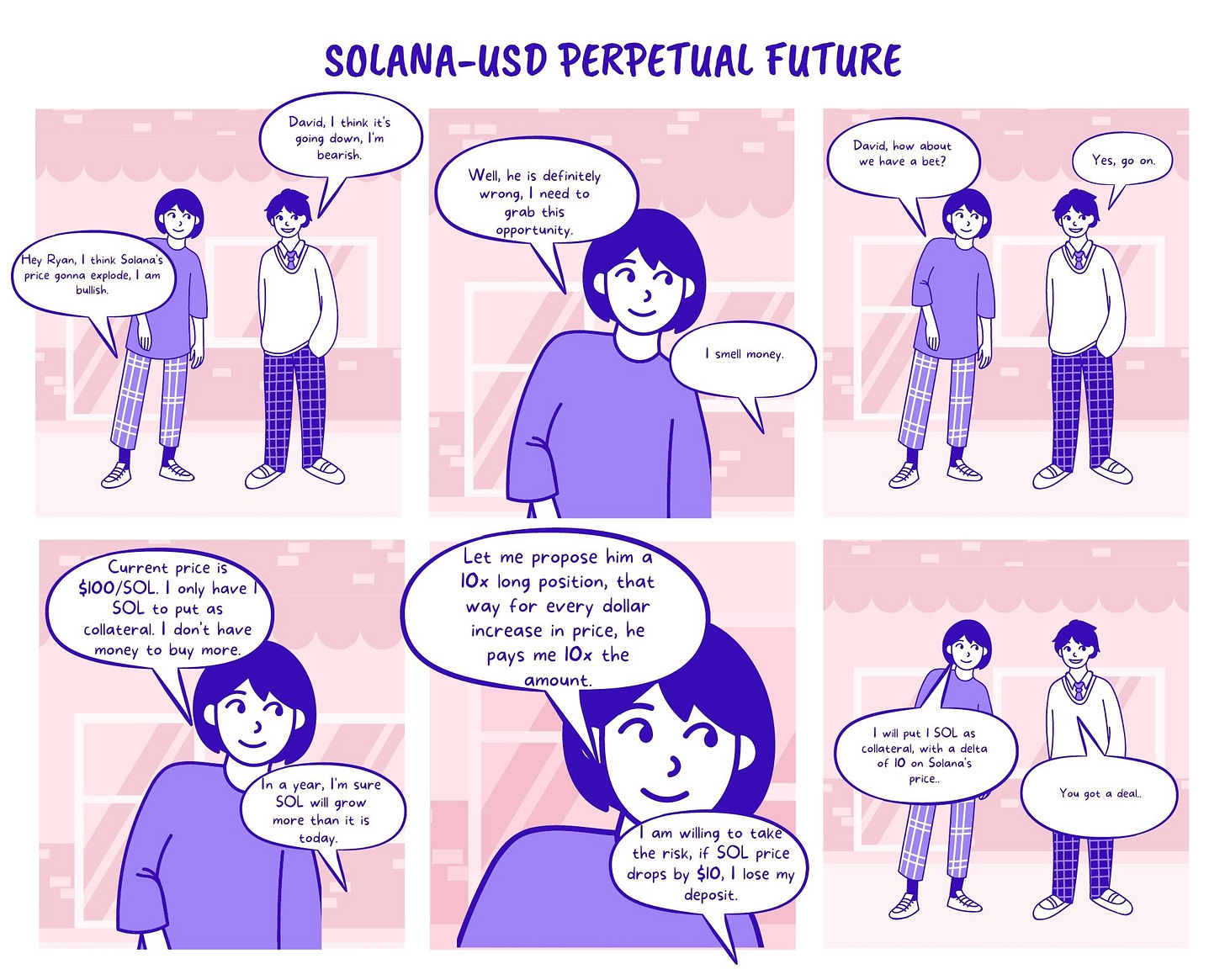

US dollar-backed stable currencies can be classified into 3 main types based on their underlying collateral structure:

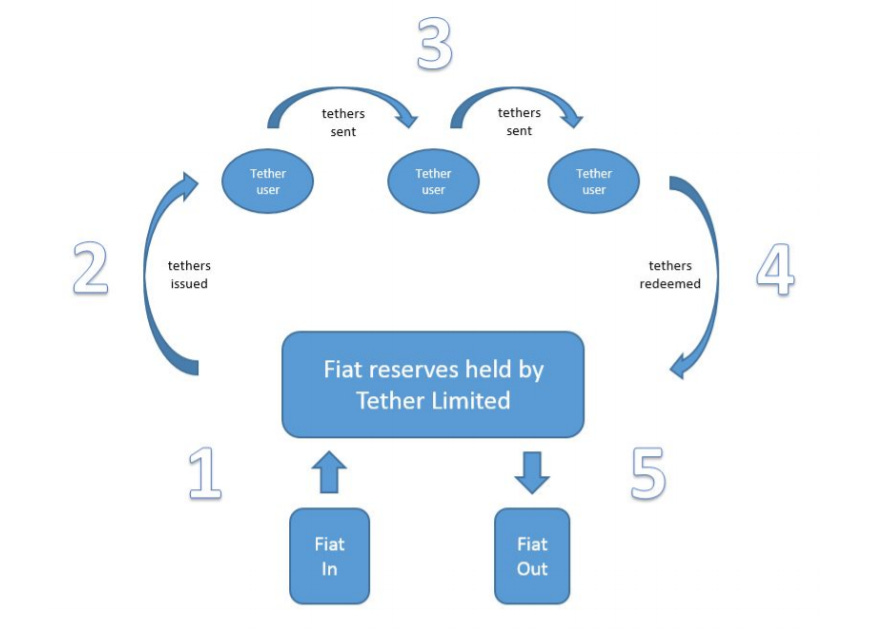

Traditional Collateral: These stablecoins are backed 1:1 with real-world fiat currencies. The fiat collateral remains with a central issuer, hence these are not decentralised and are considered an off-chain asset. Here is an example of the most famous stable coin USDT. Observe how reserves are held by a centralised custodian i.e Tether Limited.

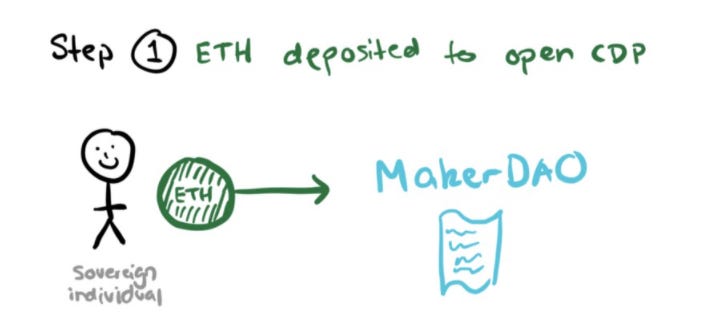

USDT Tether(Source) Crypto Collateral: These stable coins are collateralized by cryptocurrencies. User locks in cryptocurrency to mint stablecoin. Users can get their crypto collateral back by depositing their stablecoin back. The whole process occurs on-chain on a smart contract and hence it is decentralised. Crypto-collateralized stablecoins are also over-collateralized to buffer against price fluctuations in the required cryptocurrency collateral asset.

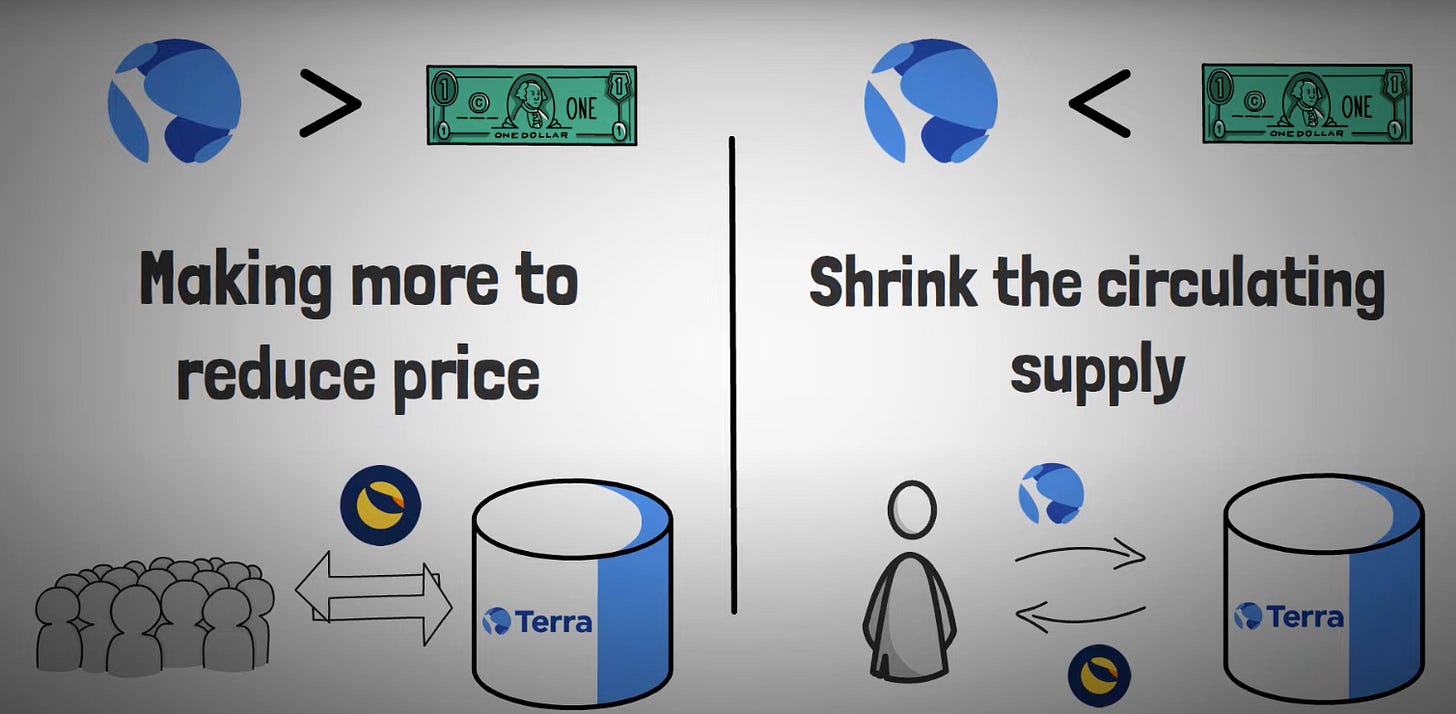

MakerDAO(source) Algorithmic Stablecoins: These do not depend upon fiat or crypto collateral instead their stability results from specialized algorithms and smart contracts that manage the supply of tokens in circulation.

Terra UST(Source)

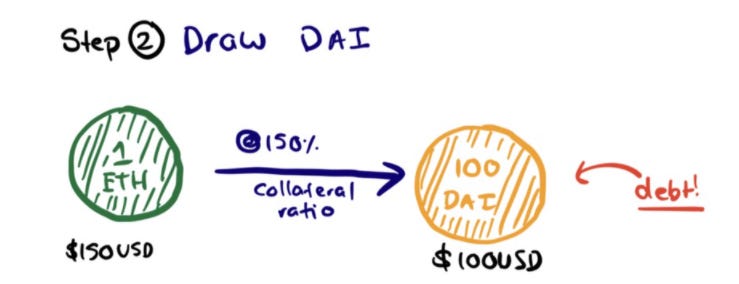

Centralised stablecoins like USDT and USDC requires users to trust someone, things can go south if funds are stolen from the reserves. There are also growing concerns about the transparency of some of these stable coin issuers. Also, transactions in these stables can be easily censored by the issuer.

Crypto collateralized stables need over-collateralised deposits and hence are not capital efficient.

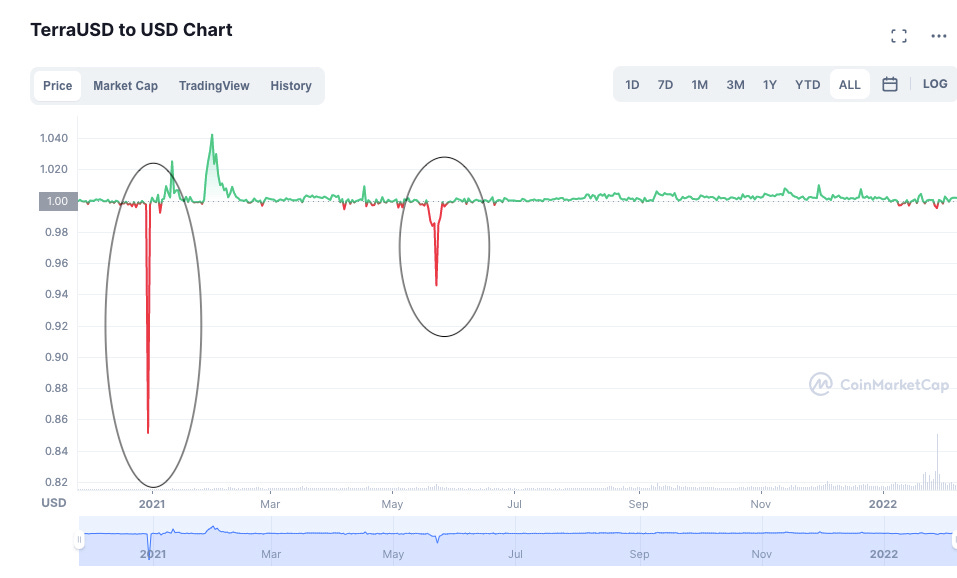

Algorithmic stable coins are the best of the lot, they are decentralised and capital-efficient, however historically they have not maintained their dollar-peg during volatility, they cannot always be considered stable.

A stablecoin trilemma stems from the above problems:

UXD stablecoin the hero of our story aims to solve this trilemma.

UXD is an Algorithmic Stablecoin 100% Backed by a Delta Neutral Position. Okay, too much to unpack here. What is the algorithm? What is Delta neutral?

We need to take a step back and simplify the above concepts.

So what is a future’s contract?

Currently 1 SOL = $1

You think it will be worth $7 in 7 days.

Your friend who has 1 SOL comes up to you and promises to sell you his SOL for $1 after 7 days, no matter what the actual price is on that day. You agree to pay after 7 days.

Congrats, you just entered a futures contract.

Scenario 1: If Sol price increases to $7 after 7 days as you predicted, you can buy 1 SOL from your friend for $1 as per your agreement and you can then sell it for $7 in the open market, making a profit of $6.

Scenario 2: If Sol price drops to $0.25 after 7 days, you still have to buy 1 SOL from your friend for $1. You just made a loss of $0.75.

In reality, you don’t really have to exchange the asset, if scenario 1 plays out, your friend will just pay you $6 and if scenario 2 plays out, you just pay your friend $0.75 to settle the contract.

This is how most of the exchanges work, you just settle in cash, instead of actually exchanging the asset.

That’s why futures are called ‘derivatives’ because the market derives value from an underlying asset without actually exchanging the asset.

Madmen in the crypto-verse were not satisfied with this and created a new investment product called perpetual futures.

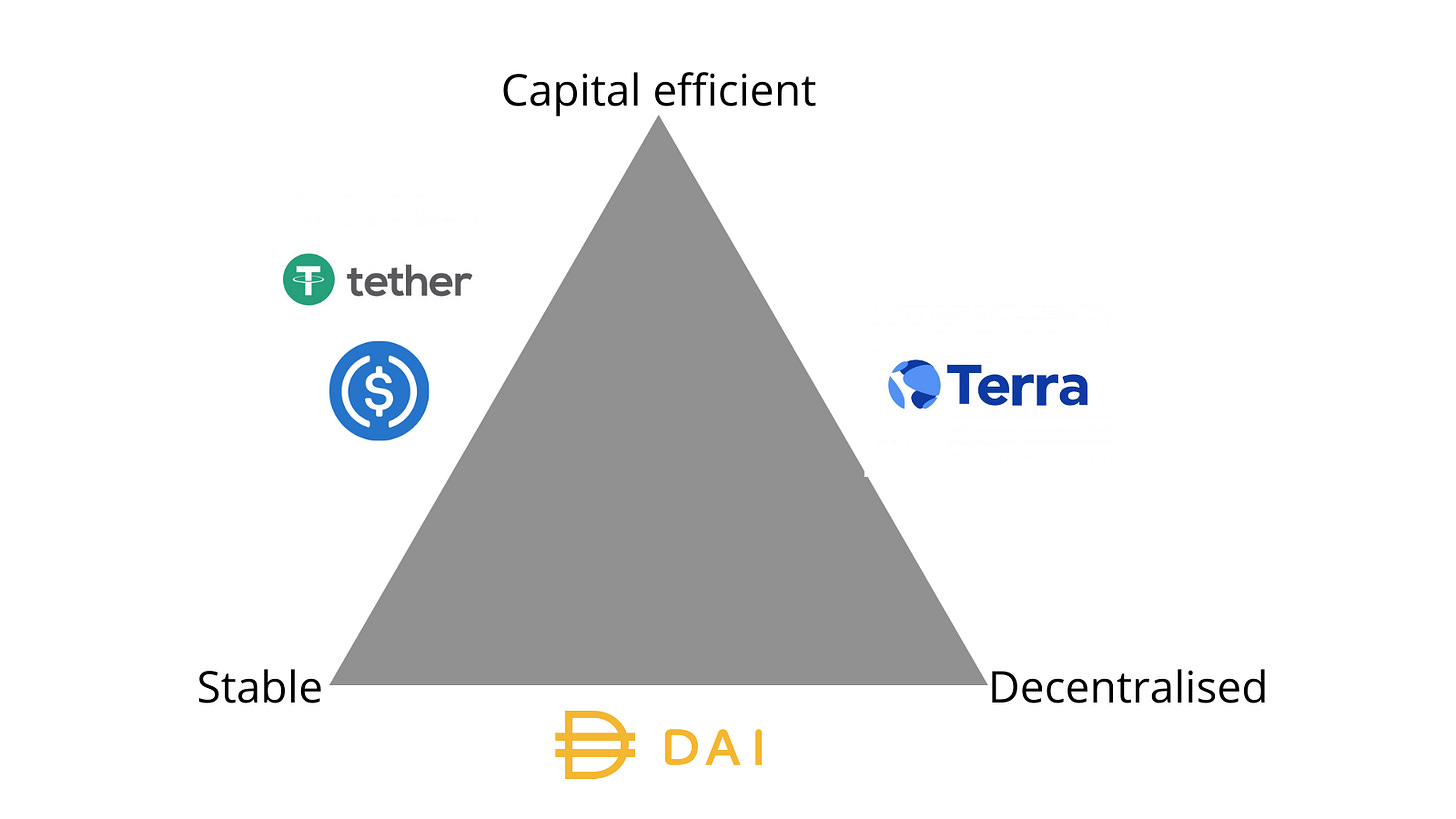

Let’s take help from Ryan and David to understand Perps.

So, David entered a Solana perpetual contract with Ryan.

A perpetual contract is a special type of futures contract where there is no expiry date.

In our previous example, no matter the circumstances, both parties had to settle the contract at a pre-determined price after 7 days. In David’s case, as long as the collateral remains intact, the deal can go on until perpetuity.

Delta determines how much I am exposed to the price movement of the underlying asset.

In David’s case, the delta is 10, hence for every $1 movement in the price of SOL he gains or loses $10.

In the real world, David does not need Ryan to enter a perpetual contract, he can use platforms like mango markets to buy a perp contract.

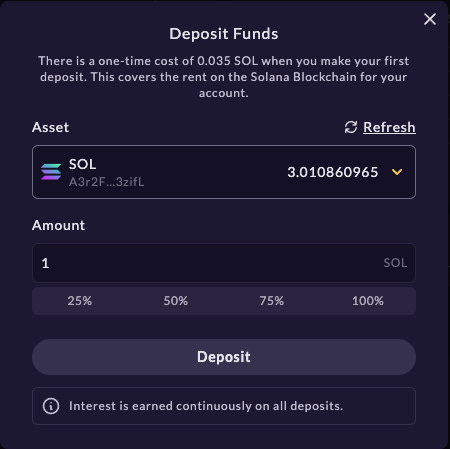

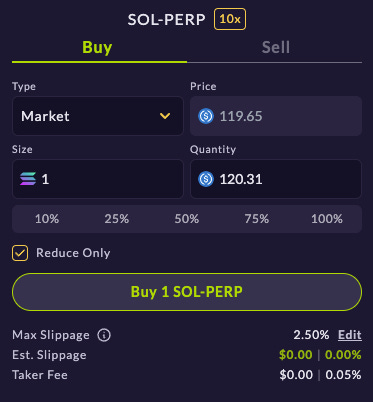

Here is how it works:

Deposit 1 SOL as collateral.

Buy 1 SOL-PERP with 10x leverage.

Check the health

When I bought the perp the value of the derivative asset i.e SOL was $120. Hence my collateral value is 1 SOL or $120.

I have taken a 10x long position hence my delta is +10.

Scenario 1: If the price of SOL hits $150, I make (150-120)x10 = $300 in profit. Since my delta is 10.

Scenario 2: If price of SOL drops to $108, I loose (108-120)x10 = $120 in loss. Remember my original collateral value was $120, hence, in this case, the protocol will automatically liquidate my position and I will lose my 1 SOL deposit.

In reality, before scenario 2 plays out, the protocol will prompt me to deposit more collateral. The call to put up more deposits is called a margin call.

Perps are amazing they give you high exposure to the asset with less initial capital and without actually buying it. However, you are taking a high risk.

So much talk about fancy trading products, we need to come back to our old friend UXD. So how does it all come together? Let's rewind the definition.

UXD is an Algorithmic Stablecoin 100% Backed by a Delta Neutral Position.

As we saw above delta determines how much I am exposed to the price movement of the underlying asset and since I took a single 10x long position, my delta is 10.

Suppose I have 2 SOL and the current price of SOL is $120. I open two positions one 10x long position with 1 SOL and a 10x short position with 1 SOL.

If the price moves up by $1, I have made a profit of $10 on my first position but I have lost the same $10 on my second position. Hence effectively my portfolio value has not changed it's still worth $240 despite movement in the price of SOL.

So how does this work for UXD protocol:

Suppose SOL/USD is trading at $120.

I deposit my 1 SOL to the UXD protocol in exchange for $120.

The protocol will then open a 1 SOL short position with 1 SOL as the collateral.

If the price of SOL increases to $200, then the value of the collateral increases by $80, simultaneously the value of the short position decreases by $80, hence my effective PnL is 0.

If the price of SOL decreases to $40, then the value of the collateral decreases by $80, simultaneously the value of the short position increases by $80, hence my effective PnL is 0.

Now trading in perpetual futures also generates some yield due to the funding rate. The concept of funding rate is way beyond the scope of this explainer.

When the funding rate is positive, the interest will be distributed to UXD Protocol Stakeholders and the insurance fund.

When the funding rate is negative, the insurance fund will be used to pay out the negative funding rate so that UXD holders do not have to pay out interest. Insurance fund may be used in case of hacks that results in de-pegging of the stablecoin because of under collateralization.

The insurance fund is governed by the upcoming UXP DAO. This brings us to the UXP token.

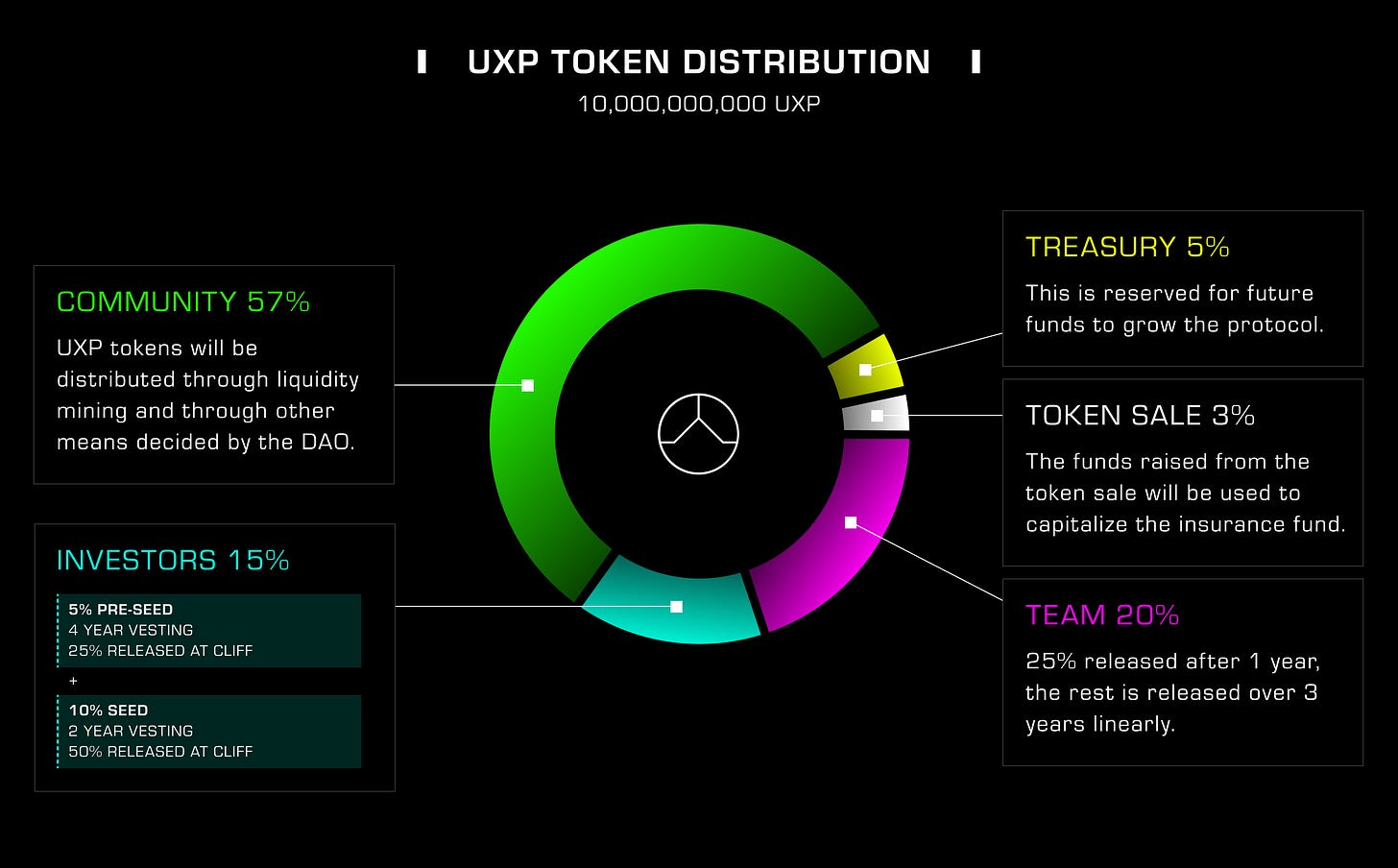

UXP is the governance token of the UXP DAO. It will be used to vote on proposals that contribute to the growth of the UXD protocol. Here is the token distribution for the UXD token.

Current supply: 300,000,000.00 UXP

Market cap: $21,314,707

Fully Diluted Market Cap: $710,237,965

These numbers are from Coin market cap. They may not be accurate.

Some of the risks involved in using the UXD protocol are:

Smart contract bugs

A negative funding rate for a long period of time may deplete the insurance fund

Insurance Fund Asset Management Risk: Insurance funds will be deployed in various asset management strategies, those strategies carry risk.

Insufficient Liquidity to Exit UXD Positions: If the derivatives exchange experiences a liquidity squeeze, there may not be enough liquidity to redeem UXD.

Supply/Demand Imbalance

Currently, UXD stablecoin is available on Solana. Go to https://app.uxd.fi/ connect your phantom wallet and get started now!!!

Sources:

https://docs.uxd.fi/uxdprotocol/

https://uxd.fi/static/media/whitepaper.7be6354b.pdf

https://www.bitcoininsider.org/article/64104/whats-makerdao-and-whats-going-it-explained-pictures

https://zephyrnet.com/what-is-tether-usdt-the-ultimate-beginners-guide/

https://www.gemini.com/cryptopedia/what-are-stablecoins-how-do-they-work

https://academy.binance.com/en/articles/what-are-perpetual-futures-contracts